Trump’s tariffs stir global trade worries. Will US allies turn to China and Russia? Read the latest at America News World.

America News World (ANW)

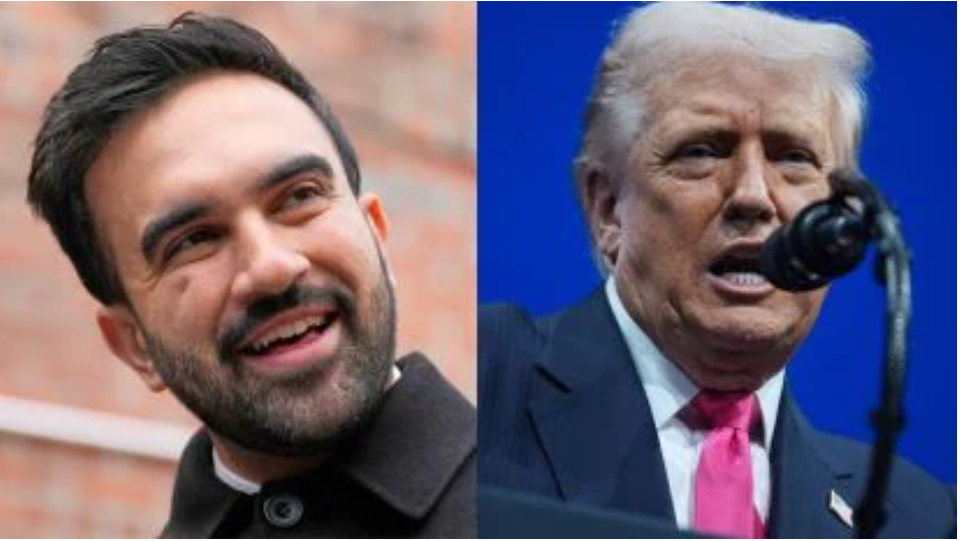

Donald Trump’s latest tariff announcement has sent shockwaves across the globe. On April 2, 2025, the US President unveiled a sweeping plan to slap hefty tariffs on imports from nearly every country. This bold move, dubbed “Liberation Day” by Trump, promises a 10% baseline tariff on all goods entering the US, with even steeper rates for nations like China (54%), Japan (24%), and South Korea (25%). But here’s the big question buzzing around: Will these tariffs push America’s allies closer to rivals like China and Russia? Let’s dive in.

At America News World (ANW), we’re breaking it down for you—simple, clear, and straight to the point. This isn’t just about numbers; it’s about people, jobs, and the future. So, grab a coffee, and let’s unpack this massive story together.

Trump’s Tariff Bombshell: What’s Happening?

Trump dropped the tariff news on April 2, standing firm in the White House Rose Garden. “We’re taking trade to a whole new level,” he declared, pen in hand, signing the executive order. The plan kicks off with a 10% tariff on all imports starting April 5. Then, on April 9, dozens of countries face higher rates based on their trade deficits with the US. China’s hit hardest at 54%, while allies like Japan and South Korea aren’t spared either.

Why? Trump says it’s about fairness. “Other countries have ripped us off for decades,” he argued. He wants to shrink the US trade deficit—$1 trillion in 2023—and bring jobs back home. But the world’s not cheering. Allies are angry, markets are shaky, and rivals like China are ready to pounce.

Transitioning to the fallout, let’s see how this plays out globally.

Allies Caught in the Crossfire

America’s friends—Canada, Japan, South Korea, and the European Union—aren’t happy. Canada, already facing a 25% tariff since March, fired back with $20.5 billion in counter-tariffs. Prime Minister Mark Carney called it “a betrayal of trust.” Japan’s Shigeru Ishiba labeled it a “national crisis,” with Tokyo’s stock market tanking. South Korea’s scrambling to protect its steel and auto industries.

Meanwhile, the EU’s gearing up for a fight. Ursula von der Leyen warned, “This risks the global economy.” On April 13, the EU plans $19 billion in tariffs on US goods—think bourbon, jeans, and machinery. It’s a tit-for-tat war, and it’s just starting.

But here’s the twist: these allies might not just sit and sulk. With US markets getting pricier, they could turn elsewhere—like China or Russia. Transitioning to that idea, let’s explore why.

China and Russia: The New Trade Buddies?

China’s already flexing its muscles. After Trump’s 54% tariff threat, Beijing vowed “resolute countermeasures.” But it’s not just talk. On March 31, China, Japan, and South Korea met for a rare trade summit. They pledged a “high-quality, mutually beneficial” free trade deal. That’s a big deal—three Asian giants cozying up while Trump swings his tariff hammer.

Russia’s in the mix too. With US-Russia trade already tiny ($3.5 billion last year), Moscow’s eager to fill gaps. During Trump’s first term, China swapped US oil and food for Russian supplies when tariffs hit. Could that happen again? Experts think so. “China and Russia stand to gain from a fractured North America,” says trade analyst María Bozmoski.

Transitioning to the data, let’s back this up with some numbers.

The Numbers Don’t Lie

Here’s a quick look at the trade stakes (data from 2023-2025 projections):

| Country | US Imports ($B) | Tariff Rate (2025) | Trade with China ($B) | Trade with Russia ($B) |

|---|---|---|---|---|

| Canada | 450 | 25% | 60 | 10 |

| Mexico | 400 | 25% | 50 | 5 |

| China | 450 | 54% | N/A | 100 |

| Japan | 150 | 24% | 200 | 15 |

| South Korea | 100 | 25% | 150 | 8 |

| EU (Total) | 500 | 20% | 600 | 50 |

Highlights:

- Canada and Mexico: Trade with the US is huge—70% of their GDP. A 25% tariff stings, pushing them to diversify.

- Japan and South Korea: Already big traders with China. A US tariff hike could double those numbers.

- China: Exports $450 billion to the US but could redirect to allies if tariffs bite too hard.

- Russia: Small player now, but ready to step up with oil and raw materials.

Transitioning to the impact, let’s see how this hits home.

What It Means for the US

Trump’s betting big. The Tax Foundation says these tariffs could rake in $290 billion in 2025—nearly 1% of GDP. That’s a win for his “America First” fans. But there’s a catch. Imports might drop by $900 billion, shrinking GDP by 0.5%. Prices? They’re going up. An iPhone could jump to $2,300, per Rosenblatt Securities. Cars might cost $3,000 more, says Bloomberg Economics.

American families could feel the pinch—$1,000 extra per household yearly, estimates Nationwide Mutual. “It’s a tax hike on us,” says economist Kathy Bostjancic. Transitioning to the global stage, allies aren’t taking it lightly.

Asia: A Pivot Point

In Asia, Trump’s tariffs could spark a real shift. Japan and South Korea, home to US military bases, face 24% and 25% tariffs. That’s a gut punch to allies. Taiwan’s hit with 32%, even as it battles China’s pressure. “This alienates partners we need against Beijing,” warns JP Morgan analyst Tom Lee.

Instead, these nations might lean on China. Their March 31 trade talks signal intent. If a deal locks in, China could grab more market share—think steel, tech, and cars. Russia’s a wildcard too, offering cheap energy to offset US losses. Transitioning to Europe, the story’s similar.

Europe’s Dilemma

The EU’s furious. A 20% tariff on its $500 billion in US exports hurts. Germany’s carmakers, like Volkswagen, could see costs soar. Retaliation’s coming—$19 billion in tariffs target US red states. But here’s the kicker: Europe’s trade with China ($600 billion) dwarfs its US ties. If Trump pushes too hard, the EU might deepen that link.

Russia’s another option. With sanctions already choking US-Russia trade, Moscow’s pitching oil and gas to Europe. “A fractured West benefits Putin,” says analyst Heather Conley. Transitioning to North America, the stakes are personal.

North America: A Family Feud

Canada and Mexico, the US’s top trade partners, are reeling. Since March 4, 25% tariffs have disrupted $850 billion in annual trade. Canada’s countermeasures hit US goods hard—$20.5 billion now, $85 billion threatened. Mexico’s holding off but ready to strike.

Both rely on the US—70% of their GDP. But China’s knocking. Mexico’s trade with Beijing ($50 billion) could grow if US doors close. Canada’s eyeing Russia for energy swaps. “This fractures North America,” warns trade expert Shannon O’Neil. Transitioning to Africa, the ripple spreads.

Africa: Caught in the Middle

Africa’s not a tariff target yet, but it feels the heat. US imports ($50 billion) face the 10% baseline. Nations like Nigeria and South Africa, big on oil and minerals, might pivot to China ($200 billion in trade) or Russia ($20 billion). “Trump’s move reshapes our options,” says Lagos-based trader Adebayo Okunola.

Transitioning to South America, the pattern holds.

South America: Opportunity Knocks

Brazil, a BRICS member, faces the 10% tariff. Its $40 billion in US exports—soy, beef—could shift to China ($100 billion trade partner). Russia’s a smaller player ($5 billion), but eager. “We’ll adapt,” says São Paulo economist Carla Mendes. Transitioning to Australia, even allies waver.

Australia: A Reluctant Ally

Australia’s dodging big tariffs—for now. PM Anthony Albanese calls it “unjustified” but won’t retaliate. Why? To keep US ties warm. Still, China’s its top partner ($150 billion). If Trump escalates, that could grow. Russia’s a long shot, but not off the table.

Transitioning to the youth angle, let’s hook the next generation.

Youth Take: Why You Should Care

Hey, Gen Z and Millennials in India and the US—this hits you. That iPhone you want? Pricier. Sneakers from Vietnam? Up 46%. Jobs? Tariffs might bring some home, but prices climb too. On america112.com, we’re tracking how this shakes your world—follow us!

Transitioning to expert views, what do the pros say?

Expert Voices

- Kathy Bostjancic, Nationwide Mutual: “Tariffs mean higher costs—$1,000 per family. Ouch.”

- Tom Lee, JP Morgan: “A 60% recession chance by year-end. This isn’t a game.”

- María Bozmoski, Atlantic Council: “China and Russia win if allies drift.”

Transitioning to the NSC drama, Trump’s not just about trade.

NSC Firings: A Side Story

While tariffs dominate, Trump’s Oval Office is buzzing. On April 2, he met far-right activist Laura Loomer. Next day, three National Security Council (NSC) staffers—Brian Walsh, Thomas Boodry, and David Feith—got the axe. Loomer pushed Trump to ditch “disloyal” aides, per CNN’s report. Was she the spark? Sources say yes. NSC’s tight-lipped, but it’s a wild subplot.

Transitioning to the big picture, what’s next?

The Road Ahead

Trump’s tariffs are a gamble. Allies might stick it out, hoping for deals. Canada and Mexico paused retaliation after talks—proof it’s not all war yet. But if push comes to shove, China and Russia are waiting. Markets agree—stocks plunged 3% on April 3, per NBC News.

For now, it’s a standoff. Trump’s power play could reshape trade—or backfire. At America News World (ANW), we’ll keep you posted.

Conclusion: Your Call

So, will Trump’s tariffs force allies to trade more with China and Russia? Maybe. Data says it’s possible—Asia’s already moving, Europe’s tempted, and North America’s tense. But deals could still save the day. What do you think? Vote on our site—Yes or No—and join the convo at america112.com.

Discover more from AMERICA NEWS WORLD

Subscribe to get the latest posts sent to your email.

![Smoke rises after Israeli strikes in Beirut's southern suburbs, on March 2 [Mohamad Azakir/Reuters]](https://america112.com/wp-content/uploads/2026/03/hgh.webp)