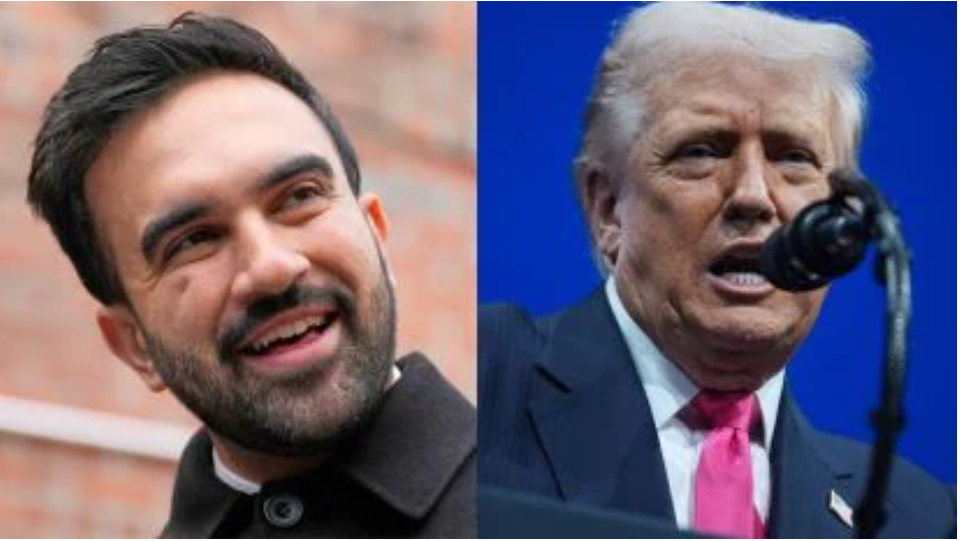

Donald Trump stunned global markets and policymakers .

On Wednesday, April 9, 2025, President Donald Trump stunned global markets and policymakers alike by announcing a dramatic escalation in his trade war with China. In a sudden shift, Trump raised tariffs on Chinese goods from 104% to a staggering 125%, effective immediately, while simultaneously pausing his broader “reciprocal” tariff plan against other nations for 90 days. This move marks a pivotal moment in U.S.-China relations, intensifying a battle that many fear the United States may not be equipped to win. As stock markets swing wildly and global leaders scramble to respond, the world braces for the economic fallout of Trump’s tariff onslaught.

A Retreat and a Doubling Down

Trump’s decision to pause tariffs on countries other than China came after a week of economic turbulence. His initial “Liberation Day” tariff announcement on April 2, delivered with characteristic bravado in the White House Rose Garden, had imposed sweeping “reciprocal” duties on dozens of U.S. trading partners. The policy triggered a sharp sell-off on Wall Street, with the Dow Jones Industrial Average plunging nearly 3,000 points in the days that followed. Economists warned of an impending recession, and even some of Trump’s staunchest allies urged a rethink.

The 90-day pause, announced via Trump’s Truth Social platform at 10:42 AM PDT today, was framed by the White House as a strategic victory. Press Secretary Karoline Leavitt claimed that “scores of nations” were rushing to negotiate trade deals with Washington, eager to avoid the punitive tariffs. Treasury Secretary Scott Bessent echoed this sentiment, calling the pause a targeted strike against “bad actors” like China, which he accused of escalating tensions with its own retaliatory measures.

Yet the exclusion of China—and the hike to 125% tariffs—tells a different story. Far from a triumph, this shift suggests a tactical retreat from a global tariff war Trump could not sustain, paired with a desperate bid to save face by doubling down on his long-standing nemesis, Beijing. The move has sharpened fears of a trade collapse between the world’s two largest economies, with ripple effects poised to reshape global commerce.

China Strikes Back

China wasted no time in responding. On Tuesday, April 8, Beijing unveiled retaliatory tariffs of 84% on U.S. goods, a significant escalation from its earlier 34% duties imposed in response to Trump’s initial salvo. Today, as Trump’s latest tariff hike took effect, Chinese state media condemned the U.S. actions as “economic bullying” and vowed to fight “to the end.” President Xi Jinping, speaking at a Communist Party conference earlier this week, avoided direct mention of Trump but called for a “shared future” with neighboring countries—a thinly veiled signal of China’s intent to deepen regional alliances against U.S. pressure.

Beijing’s confidence is palpable. Unlike Trump, who faces mounting domestic criticism over inflation and market instability, Xi operates without the constraints of electoral politics. China’s economy, while not immune to trade disruptions, has spent years preparing for such a showdown. Investments in technological self-reliance—think semiconductors, electric vehicles, and artificial intelligence—have reduced its dependence on Western markets. Meanwhile, its retaliatory toolkit remains robust: potential curbs on rare earth mineral exports, restrictions on U.S. firms operating in China, and targeted blows to American agriculture could inflict serious pain.

The Roots of the Rivalry

The U.S.-China trade war is not a new phenomenon, but Trump’s Ascendant has taken it to unprecedented heights. Its origins trace back decades, to President Richard Nixon’s 1972 visit to Beijing, which aimed to pry China away from the Soviet Union and integrate it into the global economy. By 2001, when China joined the World Trade Organization (WTO), the U.S. hoped trade would foster democracy and adherence to Western economic norms. That vision has crumbled. China’s rise as a manufacturing powerhouse gutted American industrial towns, fueling the populist wave that propelled Trump to power in 2016.

Trump’s grievances—claims of China “raping” and “pillaging” the U.S.—resonate with a bipartisan consensus in Washington that Beijing’s trade practices, from intellectual property theft to currency manipulation, are unfair. Previous administrations pursued diplomacy and targeted penalties to address these issues. Trump, however, favors blunt force. His first term saw a Phase One trade deal with China in 2020, but it unraveled amid the pandemic, leaving unresolved tensions to fester.

Now, in his second term, Trump sees this as a “one-shot” chance to reset the U.S.-China dynamic. “We’re going to make America wealthy again,” he declared on Monday, April 7, from the Oval Office. Yet his impulsive approach—lacking a clear endgame—risks backfiring spectacularly.

Economic Pain on the Horizon

For American consumers, the tariff escalation spells trouble. China supplies 16% of U.S. imports, dominating markets for smartphones, computers, and toys. With tariffs now averaging nearly 150% (including Biden-era duties), price hikes are inevitable. Small businesses, unable to pivot supply chains as swiftly as giants like Apple, face existential threats. “This is a drag on GDP, a drag on jobs, and a driver of inflation,” warned Alex Jacquez, a former Biden economic aide, in an interview today. “There’s no rational strategy here.”

The stock market’s rollercoaster reflects the uncertainty. After days of losses, the Dow surged 2,962 points today—up 7.8%—on news of the tariff pause, erasing much of last week’s decline. The S&P 500 soared 9.5%, and the Nasdaq jumped nearly 12%. Yet analysts caution that the relief may be short-lived as the China standoff deepens.

A Battle of Hubris

Both Trump and Xi are locked in a contest of wills, each staking immense political capital. Trump, who brags of countries “kissing my a**” to negotiate, cannot afford to blink after years of tough talk. Xi, styling himself as the architect of China’s resurgence, views capitulation as unthinkable—a loss of face that could weaken his grip on power.

The rhetoric is incendiary. Vice President JD Vance last week mocked China’s economy as reliant on “peasants,” ignoring its global leadership in tech and innovation. Beijing fired back, calling Vance’s remarks “ignorant” and “disrespectful.” Meanwhile, Chinese media portray Trump’s chaos as proof of American decline, touting their model of state-controlled capitalism as superior.

Experts see a prolonged struggle ahead. “Xi believes China can weather this storm,” said Lily McElwee, an adjunct fellow at the Center for Strategic and International Studies, in a phone interview today. “He’s betting the U.S. will feel the pain first.” Unlike Trump, Xi faces no midterm elections in 2026 to temper his resolve. If U.S. inflation spikes and recession looms, Trump may find himself negotiating from weakness.

Global Ripples

The tariff war reverberates beyond Washington and Beijing. Europe, hit with a 20% reciprocal tariff last week, approved countermeasures on April 8 before today’s pause offered reprieve. Japan and South Korea, facing 24% and 25% duties respectively, dispatched delegations to Washington this week. Oil prices, meanwhile, jumped 4% today as markets digested the shifting landscape.

Protests erupted globally last Friday, April 5, under the “Hands Off!” banner, decrying Trump and adviser Elon Musk as symbols of “billionaire power grabs.” From London to Washington, D.C., demonstrators signaled broader discontent with Trump’s economic gambit.

Can the U.S. Win?

Trump’s tariff onslaught hinges on a gamble: that China will buckle under pressure. Yet Beijing’s resilience—bolstered by years of preparation—casts doubt on that outcome. “This is a battle the U.S. may not win,” said former National Security Adviser John Bolton on CNN today. “It’s a huge opportunity for China to exploit.”

The stakes are monumental. A full-on trade rupture could slash global GDP, disrupt supply chains, and deepen U.S.-China enmity, with echoes of Cold War rivalry. For now, Trump’s retreat from a global tariff front has bought time, but his fixation on China risks igniting a fire neither side can easily extinguish.

As the world watches Beijing’s next move—expected Thursday morning local time—the question looms: Will Trump’s tariff war remake the global economy, or break it?

RANK

Discover more from AMERICA NEWS WORLD

Subscribe to get the latest posts sent to your email.

Leave a Reply