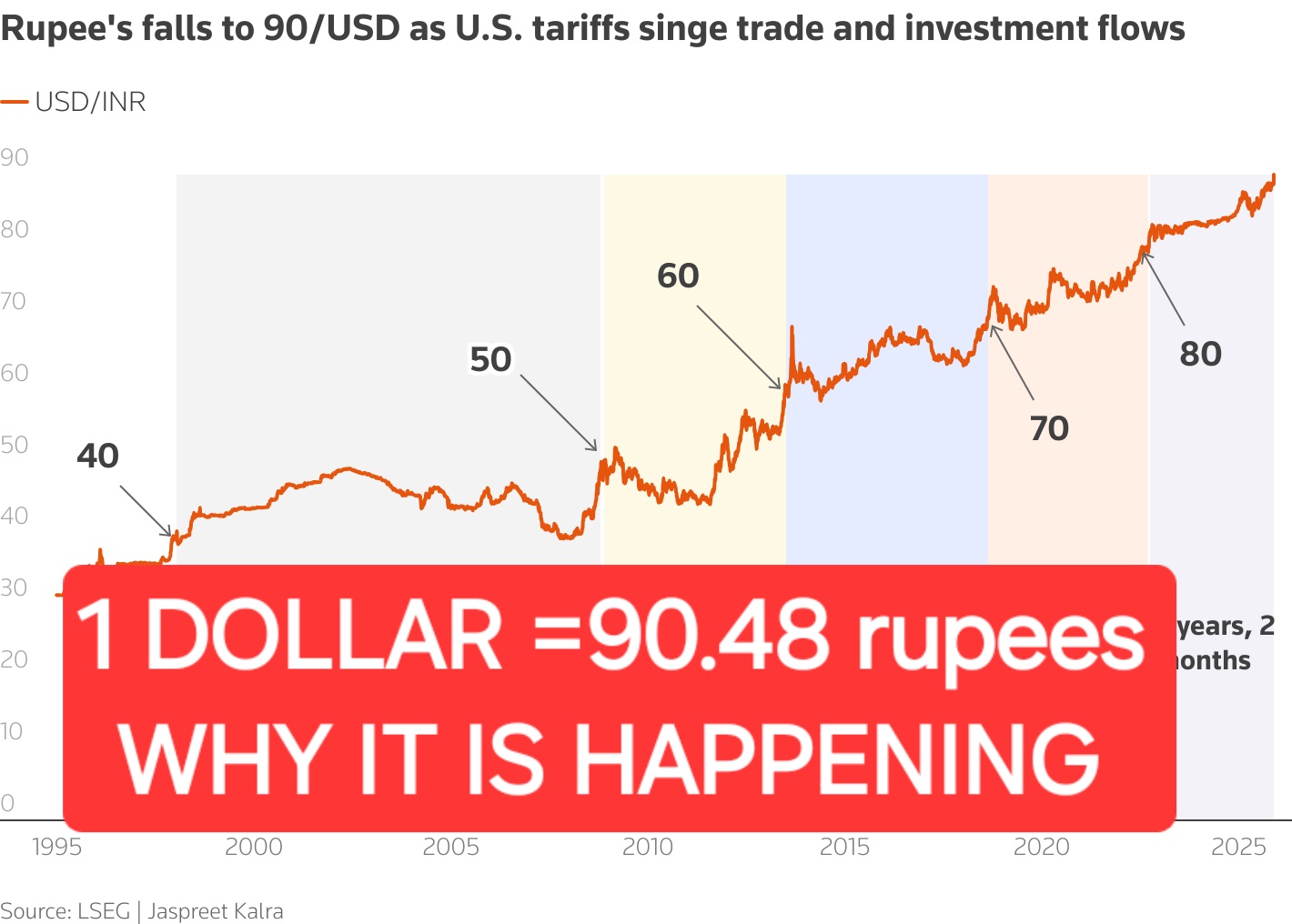

Trump’s tariffs shake global markets, sparking fears of recession. Read how this bold move impacts the world at AMERICA NEWS WORLD.

Introduction: A Bold Move Shakes the World

On April 2, 2025, U.S. President Donald Trump unleashed a massive tariff plan. He called it “very beautiful.” However, the world didn’t agree. Markets crashed. Fear spread. Countries scrambled to respond. This wasn’t just a policy—it was a shockwave. At AMERICA NEWS WORLD (ANW), we’re diving deep into this story. It’s big, messy, and affects everyone. Let’s break it down simply.

Trump’s goal? Fix trade deficits. His tool? Tariffs on over 57 countries. A flat 10% duty hit all imports. Then, sharper rates—like 54% on China—followed. He promised a “golden age” for America. But the reality? Chaos. Stocks tumbled. Investors panicked. Nations fired back. Transitioning from promise to action, this move has flipped the global economy upside down.

The Announcement: Trump’s Tariff Bombshell

It started with a speech in the White House Rose Garden. Trump stood firm. “We have massive financial deficits with China, the EU, and others,” he said on Truth Social. “Tariffs are the cure.” He added, “They’re bringing billions into the U.S.A. already.” For him, it’s simple. Tariffs mean strength. They mean jobs. They mean winning.

But the numbers tell a different story. On April 5, the 10% baseline tariff kicked in. Customs agents began collecting it at ports and airports. Then, higher rates loomed. China faces 54% on April 9. The EU gets 20%. Canada and Mexico? Similar pain. Automobiles got a 25% hit on April 3. Suddenly, the world felt the squeeze.

Transitioning to the fallout, markets couldn’t handle it. The S&P 500 lost $6 trillion in a week. The Nasdaq entered a bear market. Asia followed with a Monday crash. Trump shrugged it off. “Big business knows tariffs are here to stay,” he posted. “They’re focused on the big, beautiful deal.” But is this beauty worth the chaos?

Global Markets in Freefall: A Black Monday

Let’s talk numbers. The S&P 500 dropped 10% in two days. That’s massive. The Dow fell 7.86%. Nasdaq? Down 10.02%. Investors ran to safety. U.S. Treasury yields hit 3.92%—the lowest since October. Meanwhile, Asia’s markets bled. Japan’s Nikkei slumped. China’s Beijing Stock Exchange crashed 20%. India’s Nifty fell 1,039 points to 21,865.25.

Why the panic? Tariffs mean higher costs. Companies pay more for goods. Consumers feel it too. Inflation fears spiked. JP Morgan now sees a 60% chance of a global recession. Goldman Sachs upped its odds to 35%. Economists screamed “stagflation”—rising prices with no growth. Transitioning to the experts, they’re worried. Very worried.

Jerome Powell, U.S. Federal Reserve Chair, warned, “This could mean higher inflation and lower growth.” Trump snapped back, “Cut interest rates, Jerome!” But the damage was done. Markets turned red. Fear ruled. For everyday folks, this isn’t just numbers—it’s their savings, their jobs, their future.

The World Fights Back: Retaliation Begins

Countries didn’t sit still. China hit first. On April 10, they’ll slap a 34% tariff on all U.S. goods. They also restricted rare earth mineral exports. That’s a gut punch—those minerals power tech. The EU followed. They’re planning $28 billion in tariffs on U.S. products. Think meat, toilet paper, even Harley-Davidson bikes.

Canada joined the fray. New duties on U.S. vehicles are coming. Vietnam begged for a delay on its 46% tariff. Indonesia chose diplomacy. The UK’s Keir Starmer vowed to “shelter” businesses. Transitioning to the stakes, this isn’t just trade—it’s war. A trade war. And it’s escalating fast.

Here’s a quick look at the retaliation:

| Country | Tariff Rate on U.S. | Effective Date |

|---|---|---|

| China | 34% | April 10, 2025 |

| EU | Up to 25% | Mid-April 2025 |

| Canada | TBD (Vehicles) | TBD |

| Vietnam | 46% (Requested Delay) | April 9, 2025 |

This tit-for-tat could choke global supply chains. Businesses are scared. Consumers will pay more. The question is: How far will this go?

Trump’s Vision: A “Golden Age” or a Gamble?

Trump sees a bright future. “Jobs and factories will roar back,” he promised. He believes tariffs will force companies home. He’s betting on a reset—tough love for a stronger America. “It’s a great time to get rich,” he said. His team backs him. Commerce Secretary Howard Lutnick told CBS, “We’re resetting global trade.”

But critics see danger. They compare this to the 1930 Smoot-Hawley Act. Back then, tariffs sparked a trade war. The Great Depression got worse. History looms large. Transitioning to the risks, experts warn of a repeat. Supply chains could break. Prices could soar. Growth could stall.

Here’s a graph of U.S. trade deficits Trump targets:

| Country | Trade Deficit (2024, $B) | Tariff Rate (2025) |

|---|---|---|

| China | 375 | 54% |

| EU | 180 | 20% |

| Canada | 50 | 25% (Vehicles) |

| Mexico | 150 | 25% (Vehicles) |

Trump’s betting billions will flow back. But will they?

The Human Cost: What It Means for You

Let’s get real. Tariffs aren’t just policy—they hit wallets. In the U.S., prices might jump. Electronics? More expensive. Cars? Pricier. Groceries? Up too. Retailers like Walmart could pass costs on. For a family of four, that’s hundreds extra a year. Savings shrink. Stress grows.

Globally, it’s worse. In India, tech firms brace for pain. In Europe, carmakers pause shipments. In Africa, small traders fear losses. Transitioning to the ripple effect, this touches everyone. From New York to New Delhi, the impact spreads. Jobs hang in the balance. Hope fades for some.

Here’s a cost breakdown:

| Item | Pre-Tariff Price | Post-Tariff Estimate |

|---|---|---|

| Smartphone | $500 | $550-$600 |

| Car | $30,000 | $32,500-$35,000 |

| TV | $800 | $880-$920 |

It’s not abstract—it’s personal.

Voices of the World: Leaders React

Leaders didn’t hold back. China’s Vice Commerce Minister called it “economic bullying.” The EU’s Ursula von der Leyen warned of a “systemic shock.” Canada’s Mark Carney prepared countermeasures. Japan’s Fumio Ishiba feared “instability.” The UK’s Starmer pushed talks. Everyone’s on edge.

Protests erupted too. In the U.S., 600,000 rallied against Trump and Elon Musk. Germany saw massive marches. Transitioning to the streets, people are angry. They’re scared. They want answers. But Trump? He’s golfing in Florida, unfazed.

The Economic Debate: Boom or Bust?

Economists split hard. Some back Trump. They say tariffs could boost U.S. manufacturing. Jobs might return. Growth could follow. But most disagree. They see chaos. “We’re headed for recession,” said Peter Tchir of Academy Securities. “This is a disaster.”

Goldman Sachs predicts pain. J.P. Morgan too. The IMF expects a 3.3% growth drop. Transitioning to the data, here’s their outlook:

| Institution | Recession Odds | Growth Impact |

|---|---|---|

| JP Morgan | 60% | -0.3% GDP |

| Goldman Sachs | 35% | -0.5% GDP |

| IMF | N/A | -3.3% Global |

Who’s right? Time will tell.

AMERICA NEWS WORLD: Why This Matters to Us

At AMERICA NEWS WORLD, we’re not just reporting—we’re connecting. This story hits the U.S. and India hard. Our readers—teens to seniors—need clarity. From Wall Street to Mumbai, we’re your bridge. We dig deep. We keep it real. Visit us at america112.com

Trump’s tariffs are a wild ride. They’re bold. They’re risky. They’re shaking everything. At AMERICA NEWS WORLD, we’re here to unpack it. For India, the U.S., and beyond—visit america112.com. Let’s navigate this chaos together.

Discover more from AMERICA NEWS WORLD

Subscribe to get the latest posts sent to your email.

![Smoke rises after Israeli strikes in Beirut's southern suburbs, on March 2 [Mohamad Azakir/Reuters]](https://america112.com/wp-content/uploads/2026/03/hgh.webp)