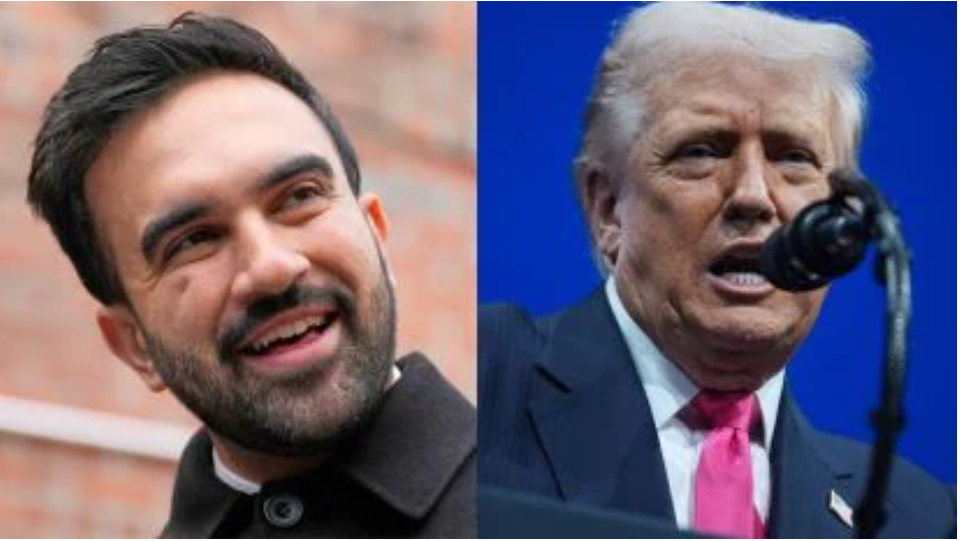

The US House of Representatives passed the large scale tax and expenditure bill of President Donald Trump on Thursday, July 3, 2025 in a tight 218-214 votes. Known as the “One Big Beautiful Bill Act”, the law is a major victory for Trump in its second term. As a result, it now moves to its desk to sign the eastern time on July 4, 2025 at 5 pm. The bill, which approves the Senate with the tie-breaking vote of Vice President JD Vance, promises major changes for Americans. But what does it mean to you? Let’s break it. ### What is in the bill? The bill spread over 869 pages, makes Trump’s 2017 tax deduction permanent. Additionally, it introduces new tax brakes for parents, senior, overtime workers, and talled workers, which fulfills the 2024 campaign promises. For example, it offers $ 6,000 deduction for seniors earned under $ 75,000 and eliminates taxes on tips and overtime pay. In addition, it includes a $ 50 billion fund to support rural health providers, resolving concerns about the medicid cut. However, the bill comes with a heavy price. According to the Congress Budget Office (CBO), it will add $ 3.4 trillion to the country’s $ 36.2 trillion loans in the next decade. It mainly cuts federal expenses by $ 1.1 trillion via the deduction in the medicine. As a result, CBO estimates that about 12 million people may lose healthcare coverage due to tight eligibility and work requirements. This has created a terrible debate, especially among the Democrats. ### why it matters Republican led by House Speaker Mike Johnson is called Bill “Jet Fuel for Economy”. He argues that it will promote growth by investing more money in the pockets of Americans. “All boats will grow,” Johnson said after the vote. On the other hand, Democrats, led by House Minority Leader Hakim Jeffrees, slammed it as a GiveawHakim Jeffrees slammed it as a cheaper for rich. Jeffrees made history with eight hours, 46 -minute speech to delay the vote, called it “the longest in the house history”. He warned that the cuts in security pure programs like Medicid will harm Americans everyday. Only two Republicans, Bryan Fitzpatric of Pennsylvania and Thomas Massey of Kentki voted against the bill. Massey argued that it had not spent enough. Meanwhile, the Democrats united in the opposition, vowed to make the bill an important issue in the mid -term elections of 2026. For now, the tax relief of the bill is expected to kick soon, but its long -term effects remain a warm subject. ### Economic and Global Impact The bill increases the federal debt roof by $ 5 trillion, to avoid a near-term default. However, economists worry about long -term fiscal approaches. In May 2025, Moody’s downed the US debt, which cites concerns at uncertain expenses. Globally, investors are looking closely, as the increase in bill deficit can affect American credibility. Additionally, the law eliminates tax encouragement for green energy, such as electric vehicle credits, and fossils increase funds for fuel production. This change has criticized environmental groups but align with Trump’s energy agenda. In addition, it allocates $ 175 billion for immigration enforcement, which includes $ 45 billion for detention facilities and $ 14 billion for exile. The purpose of these measures is to support Trump’s ambitious anti -immigration schemes. ### Public reaction and what is next Public sentiment is mixed. Post on the X shows something praising the tax deduction of the bill, in which a user calls it “a win for working families”. Others, however, worry about healthcare cuts. [NBC News] (https://www.nbcnews.com) shows deep doubt about a recent pole quoted by)Hakim Jeffrees slammed it as a cheaper for rich. Jeffrees made history with eight hours, 46 -minute speech to delay the vote, called it “the longest in the house history”. He warned that the cuts in security pure programs like Medicid will harm Americans everyday. Only two Republicans, Bryan Fitzpatric of Pennsylvania and Thomas Massey of Kentki voted against the bill. Massey argued that it had not spent enough. Meanwhile, the Democrats united in the opposition, vowed to make the bill an important issue in the mid -term elections of 2026. For now, the tax relief of the bill is expected to kick soon, but its long -term effects remain a warm subject.

### Economic and Global Impact

also read:-RECITAL BLOG

also read:Boulder Terror Attack Shocks US and India

also read:Hamas Agrees to Free 10 Hostages in US Deal

The bill increases the federal debt roof by $ 5 trillion, to avoid a near-term default. However, economists worry about long -term fiscal approaches. In May 2025, Moody’s downed the US debt, which cites concerns at uncertain expenses. Globally, investors are looking closely, as the increase in bill deficit can affect American credibility. Additionally, the law eliminates tax encouragement for green energy, such as electric vehicle credits, and fossils increase funds for fuel production. This change has criticized environmental groups but align with Trump’s energy agenda. In addition, it allocates $ 175 billion for immigration enforcement, which includes $ 45 billion for detention facilities and $ 14 billion for exile. The purpose of these measures is to support Trump’s ambitious anti -immigration schemes. ### Public reaction and what is next Public sentiment is mixed. Post on the X shows something praising the tax deduction of the bill, in which a user calls it “a win for working families”. Others, however, worry about healthcare cuts. [NBC News] (https://www.nbcnews.com) shows deep doubt about a recent pole quoted by)

Discover more from AMERICA NEWS WORLD

Subscribe to get the latest posts sent to your email.