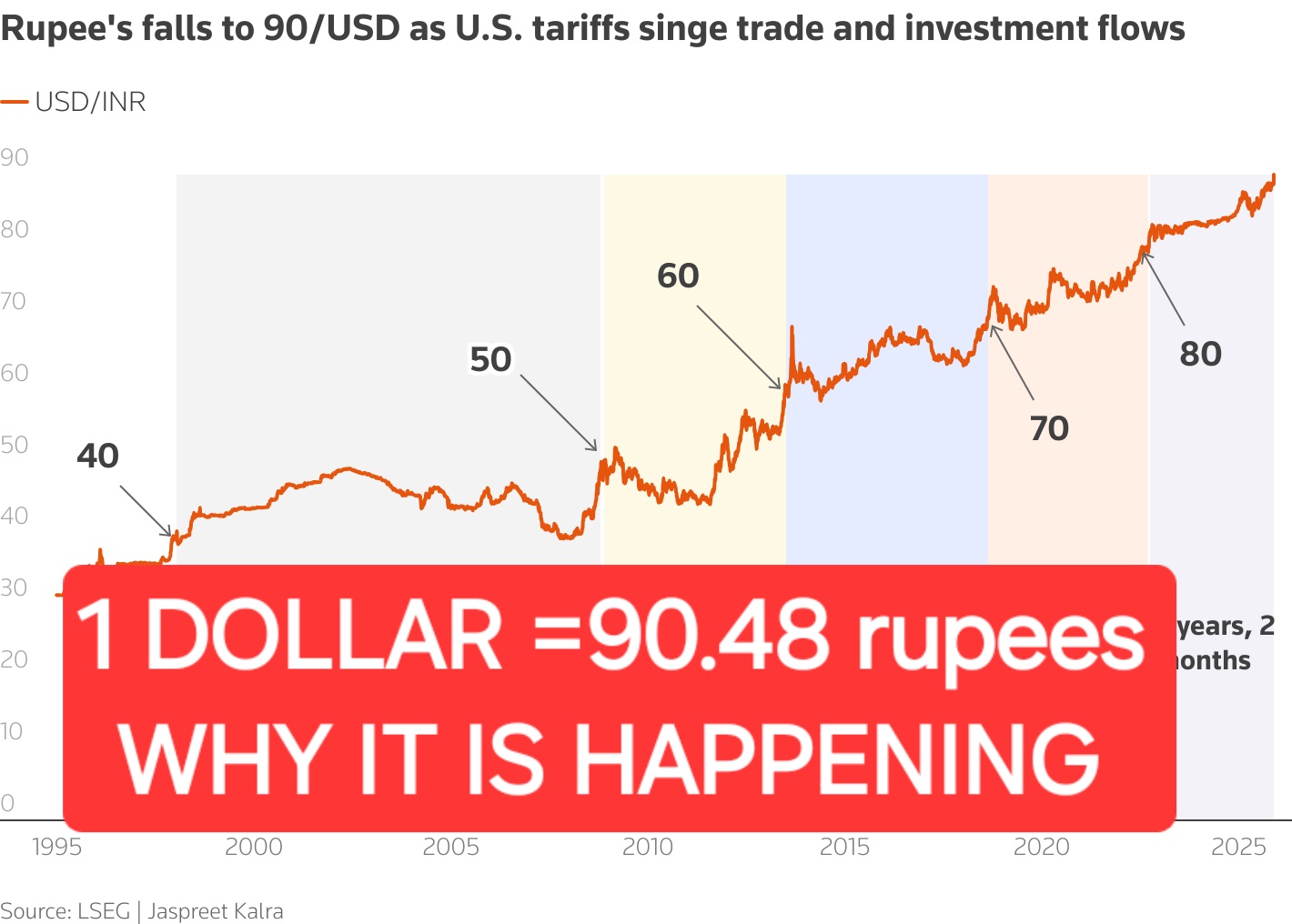

In a bold move, U.S. President Donald Trump has doubled tariffs on Indian goods, raising them to a hefty 50% as a penalty for India’s continued purchase of Russian oil. This decision, announced on August 6, 2025, has stirred up a storm in global trade circles. India’s Ministry of External Affairs quickly fired back, calling the tariffs “unfair, unjustified, and unreasonable.” But why is India being singled out? And what does this mean for trade and diplomacy? At AMERICA NEWS WORLD, we break it down for you in simple terms.

Why the Tariffs?

Trump signed an executive order targeting India’s imports of Russian oil, which hit 1.75 million barrels daily in the first half of 2025. He claims India is “fueling Russia’s war machine” in Ukraine by buying cheap oil and reselling refined products for profit. “It’s only been eight hours. You’re going to see a lot more secondary sanctions,” Trump told reporters, hinting at similar measures for other countries like China. The new 25% tariff, stacked on an existing 25% levy, will kick in after 21 days, starting August 27, 2025.

India, however, argues it’s being unfairly targeted. The Ministry of External Affairs pointed out that the U.S. itself traded $3.5 billion worth of goods with Russia last year, despite its own sanctions. “Our imports are based on market factors and the energy needs of 1.4 billion people,” the ministry said in a statement. For a deeper dive into global trade dynamics, check out Reuters for real-time updates.

How Will This Hit India’s Economy?

The 50% tariff will affect key Indian exports like textiles, gems, jewelry, auto parts, and seafood. These sectors employ millions, and experts warn of a potential GDP slowdown. According to A Prasanna, Chief Economist at ICICI Securities, the tariffs could shave 0.3% off India’s growth. However, pharmaceuticals and electronics like iPhones are exempt for now, softening the blow.

To show the impact, here’s a chart of India’s top exports to the U.S. in 2024:

**, we break it down for you in simple terms.](https://i0.wp.com/america112.com/wp-content/uploads/2025/08/chart-83.png?resize=623%2C433&ssl=1)

This chart, optimized for both mobile and desktop, highlights the sectors at risk. Textiles and gems face the steepest tariffs, while pharma remains safe for now.

India’s Defiant Stand

India isn’t backing down. The government insists its oil purchases stabilize global markets, preventing price spikes like the $137 per barrel seen in 2022. “We’re not the only ones buying Russian oil,” an Indian official told AMERICA NEWS WORLD. Indeed, China, the largest buyer of Russian oil, imports $128.3 billion worth of goods annually, yet hasn’t faced similar tariffs yet. India’s defiance could push it closer to BRICS allies like Russia and China, shifting global alliances.

What Are Secondary Sanctions?

Trump’s mention of “secondary sanctions” has raised eyebrows. These are penalties on countries or companies doing business with sanctioned nations like Russia. For example, the U.S. has used similar measures against buyers of Venezuelan oil. If Trump follows through, countries like Brazil, which also faces 50% tariffs, could feel the heat. This could disrupt global oil supplies, potentially raising Brent crude prices by $6-$11 per barrel, according to analysts Brooks and Harris.

Here’s a breakdown of countries facing U.S. tariffs in 2025:

Global Reactions and What’s Next?

The tariffs have sparked outrage in India. Social media posts on platforms like X show frustration, with users like Venu Gopal urging India to “stand up against this unreasonable tariff.” Others, like Ajay, predict U.S. consumers will bear the cost through higher prices. Meanwhile, Trump’s envoy, Steve Witkoff, met with Russia’s Vladimir Putin to push for a Ukraine ceasefire, suggesting these tariffs are part of a broader strategy to pressure Russia.

For India, the next 21 days are critical. Officials hint at possible negotiations to reduce Russian oil imports gradually. However, with long-term contracts and energy needs at stake, a quick fix seems unlikely. If India retaliates with tariffs on U.S. goods like oil and aerospace products, American consumers could feel the pinch too.

Why This Matters to You

Whether you’re in India, the U.S., or anywhere else, these tariffs could affect you. Higher costs for Indian goods may raise prices in the U.S., while India’s economy faces risks. For readers in India, this is a call to stay informed about how global trade impacts local jobs and prices. At AMERICA NEWS WORLD, we’re committed to keeping you updated with clear, reliable news.

Discover more from AMERICA NEWS WORLD

Subscribe to get the latest posts sent to your email.

![Smoke rises after Israeli strikes in Beirut's southern suburbs, on March 2 [Mohamad Azakir/Reuters]](https://america112.com/wp-content/uploads/2026/03/hgh.webp)