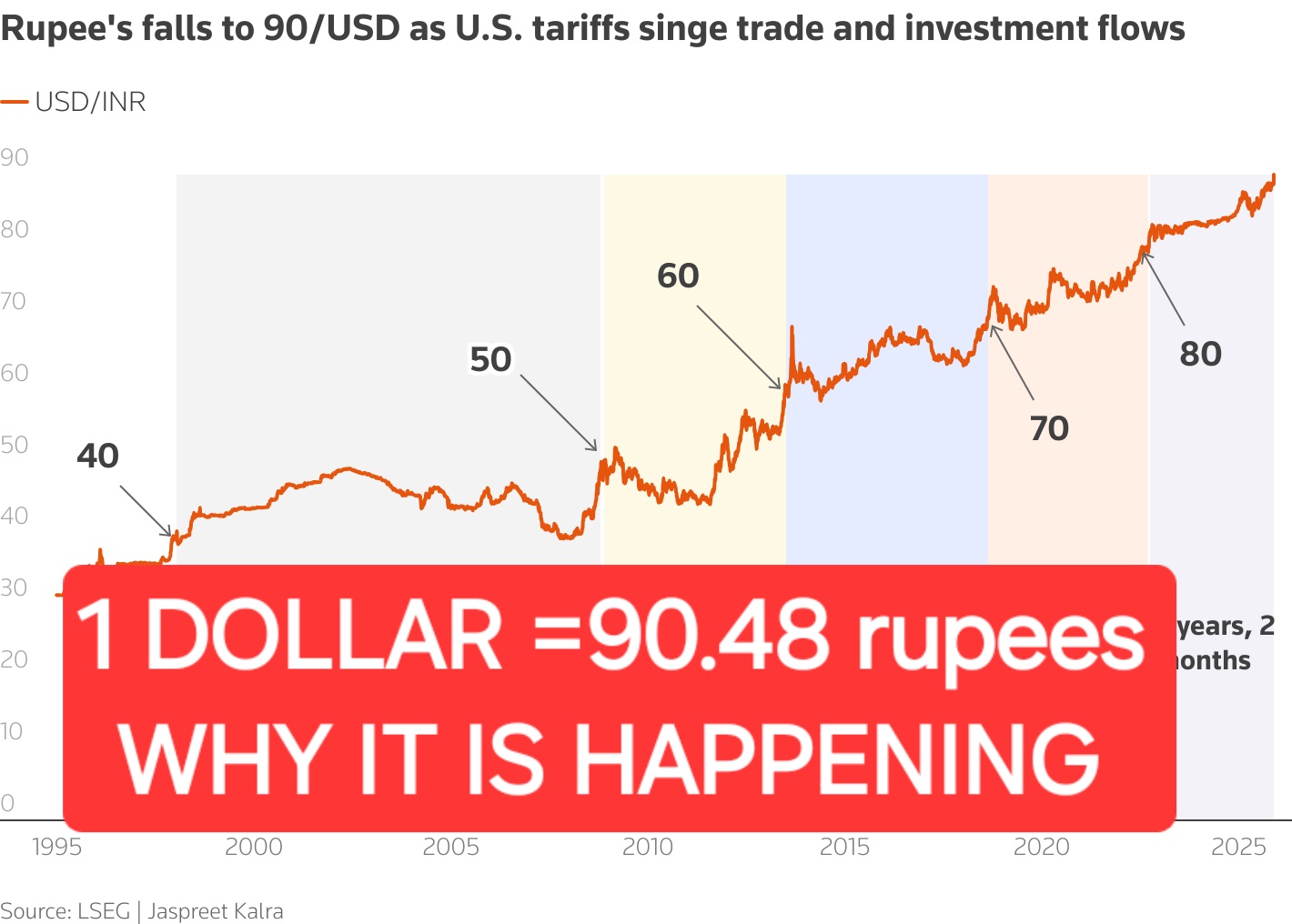

Today, we’re diving into a major story shaking global markets: the Indian rupee’s dramatic fall to an all-time low against the US dollar. This comes as India and the US edge closer to a key trade deal by March 2026. From Washington to Mumbai, experts say this could reshape trade ties and impact American businesses. Stay tuned for simple breakdowns of breaking news

around 90.48-90.51 on December 11, 2025. The upward trend in USD/INR means the rupee is weakening. Check America News World for more on how this affects US-India trade and global markets!

The rupee dropped 54 paise to hit 90.48 against the dollar in early trading on Thursday, December 11, 2025.

Forex traders blame strong dollar demand from Indian importers and a cautious global mood.

India’s Chief Economic Advisor V. Anantha Nageswaran shared that a US-India trade deal looks likely by March 2026.

This news sparked the sharp fall, as markets weigh the deal’s benefits against current trade hurdles.

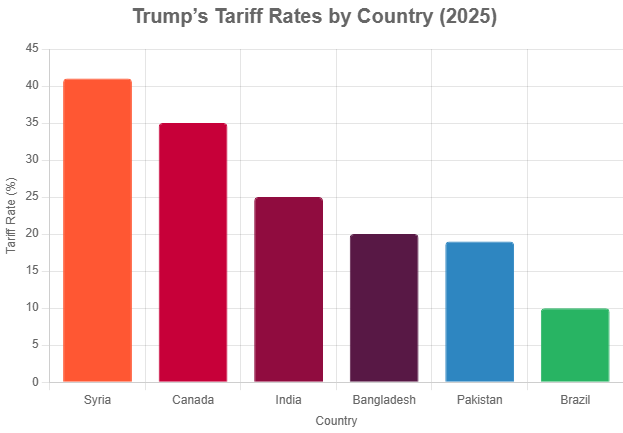

US officials call India’s offers the “best ever,” but tariffs remain a sticking point.

The rupee started the day at 89.95 but quickly slid to its record low of 90.48.

On Wednesday, it closed at 89.87, showing a steady weakening trend this year.

Analysts note Mexico’s new 50% tariffs on Asian goods, including from India, added pressure.

Foreign investors sold Indian debt as yields rose, hurting the rupee further.

US and Japanese bond yields climbed, making the dollar more attractive worldwide.

US Trade Representative Jamieson Greer praised India’s proposals during Senate hearings on December 9.

He said talks aim to wrap up the first phase of a Bilateral Trade Agreement soon.

But Greer admitted India is a “tough nut to crack” on issues like US farm exports.

Row crops such as corn, soybeans, wheat, and cotton face resistance in India.

These details matter as both sides push for a deal to boost exports by 2030.

India’s Commerce Secretary Rajesh Agrawal met US Deputy Trade Rep Rick Switzer this week.

They discussed easing tariffs that hit Indian goods hard, especially after US penalties on Russian oil buys.

The US slapped 25% tariffs plus 25% extras on some Indian imports, totaling 50%.

President Trump even threatened more on Indian rice, citing unfair dumping.

A deal could lift these barriers and open doors for American farmers and manufacturers.

The dollar index, tracking the greenback against major currencies, dipped 0.17% to 98.61 today.

This followed the Federal Reserve’s third rate cut this year, easing to support growth.

Fed Chair Jerome Powell gave mild guidance, not too hawkish, calming markets a bit.

Still, the rupee’s woes highlight broader emerging market strains from a strong dollar.

Experts predict the rupee could test 91 soon if trade talks drag on.

around 90.48-90.51 on December 11, 2025. The upward trend in USD/INR means the rupee is weakening. Check America News World for more on how this affects US-India trade and global markets!

Oil prices also played a role in today’s sentiment.

Brent crude fell 1.17% to $61.48 per barrel in futures trading.

Lower energy costs help importers like India but signal weak global demand.

Recent US seizures of Venezuelan oil tankers raised supply fears, but prices stayed down.

This mix keeps inflation in check but worries economists about slower growth ahead.

Back in India, stock markets showed mixed reactions to the rupee’s plunge.

The Sensex rose 443.66 points to 84,834.93, snapping a short losing streak.

Nifty climbed 141.05 points to 25,899.05, led by gains in autos and metals.

Foreign investors sold equities worth ₹1,651 crore on Wednesday, per exchange data.

Yet, optimism around the trade deal lifted investor spirits in key sectors.

For American readers, this story hits close to home.

US companies like Apple and Google rely on Indian manufacturing and talent.

A stronger trade deal could mean lower tariffs on US tech exports to India.

It might also ease visa rules for skilled Indian workers in America.

Trump’s “gold card” visa program, starting at $1 million, aims to attract top global talent.

Trade tensions aren’t new between the two giants.

The US runs a trade surplus with India in services but deficits in goods.

India wants more access for its textiles and pharma; America pushes agriculture.

Recent talks in New Delhi focused on a framework to cut reciprocal tariffs.

Success here could add billions to bilateral trade, now over $190 billion yearly.

Chief Economic Advisor Nageswaran’s comments fueled the rupee’s drop.

He said the deal is “likely” by March, but details on farm concessions lag.

Indian farmers protest any opens to US meat and dairy products.

Urban consumers worry about higher food prices if imports flood in.

Balancing these views is key to sealing the pact without domestic backlash.

Global markets watch closely as the Fed’s cuts ripple out.

Emerging currencies like the rupee bear the brunt of dollar strength.

Asia’s trade wars, from Mexico’s tariffs to US-China spats, add fuel.

Analysts at Finrex Treasury say FPIs will keep selling until yields stabilize.

A quick deal could reverse the rupee’s slide and boost confidence.

In Washington, Senate hearings highlighted the stakes.

Greer noted India’s “best ever” offers but stressed tough agriculture talks.

The US wants India to ease bans on certain meats and row crops.

India counters with demands for fair steel and auto part access.

These negotiations, started in February, target a fall 2025 wrap-up for phase one.

Oil’s downturn ties into broader energy shifts.

US sanctions on Venezuelan oil tighten supply, but global stocks are high.

Brent at $61.48 eases India’s import bill, a small silver lining.

Yet, lower prices signal recession fears in Europe and China.

America’s shale boom keeps US exports steady amid these swings.

Indian stocks’ rebound shows resilience.

Auto firms like Maruti gained on hopes of export boosts from the deal.

Metals rose as global demand picks up post-Fed cut.

Small and mid-caps outperformed, up nearly 1% in broader indices.

This uptick counters three days of losses from foreign outflows.

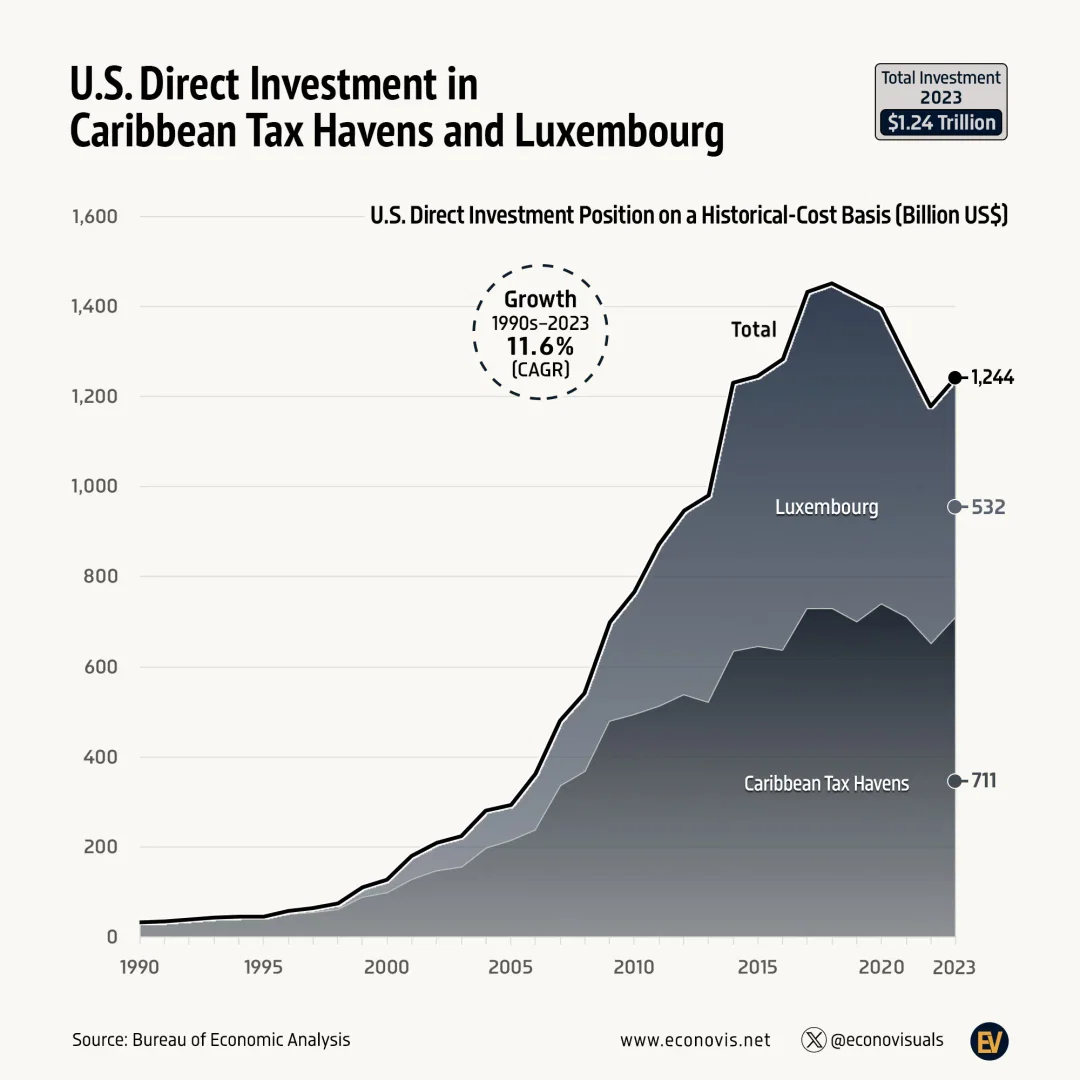

For US investors, opportunities emerge in India.

A trade deal could spur joint ventures in renewables and tech.

Trump’s team eyes $35 billion in new US investments by 2030.

Indian firms like Infosys deploy Microsoft tools, creating US jobs.

Watch for visa reforms to bring more H-1B talent stateside.

The rupee’s record low sparks debate on intervention.

India’s central bank may sell dollars to prop it up soon.

Reserves stand at $650 billion, giving room to act.

But officials prefer market forces over heavy-handed fixes.

A stable rupee aids remittances, vital for many Indian-American families.

Trade talks build on past wins like the 2023 mini-deal.

That eased some tech tariffs; now, scope widens to $500 billion by 2030.

Challenges include India’s subsidies and US farm lobbies.

Success would mark a win for Trump’s “America First” abroad.

Failure risks escalating tariffs, hurting both economies.

As markets close, the dollar index holds at 98.61.

Brent crude’s dip to $61.48 caps energy costs globally.

Sensex and Nifty gains signal cautious optimism in Asia.

The rupee’s path hinges on trade progress and Fed signals.

Tomorrow brings more talks; watch for breakthroughs.

Wrapping up, **America News World** keeps you ahead on **latest news** like this rupee plunge.

From US-India ties to global finance, we simplify the complex.

What does this mean for your portfolio or business?

Share your thoughts in comments.

Tune in for updates on **world news** and **US economy** impacts.

Discover more from AMERICA NEWS WORLD

Subscribe to get the latest posts sent to your email.

Leave a Reply