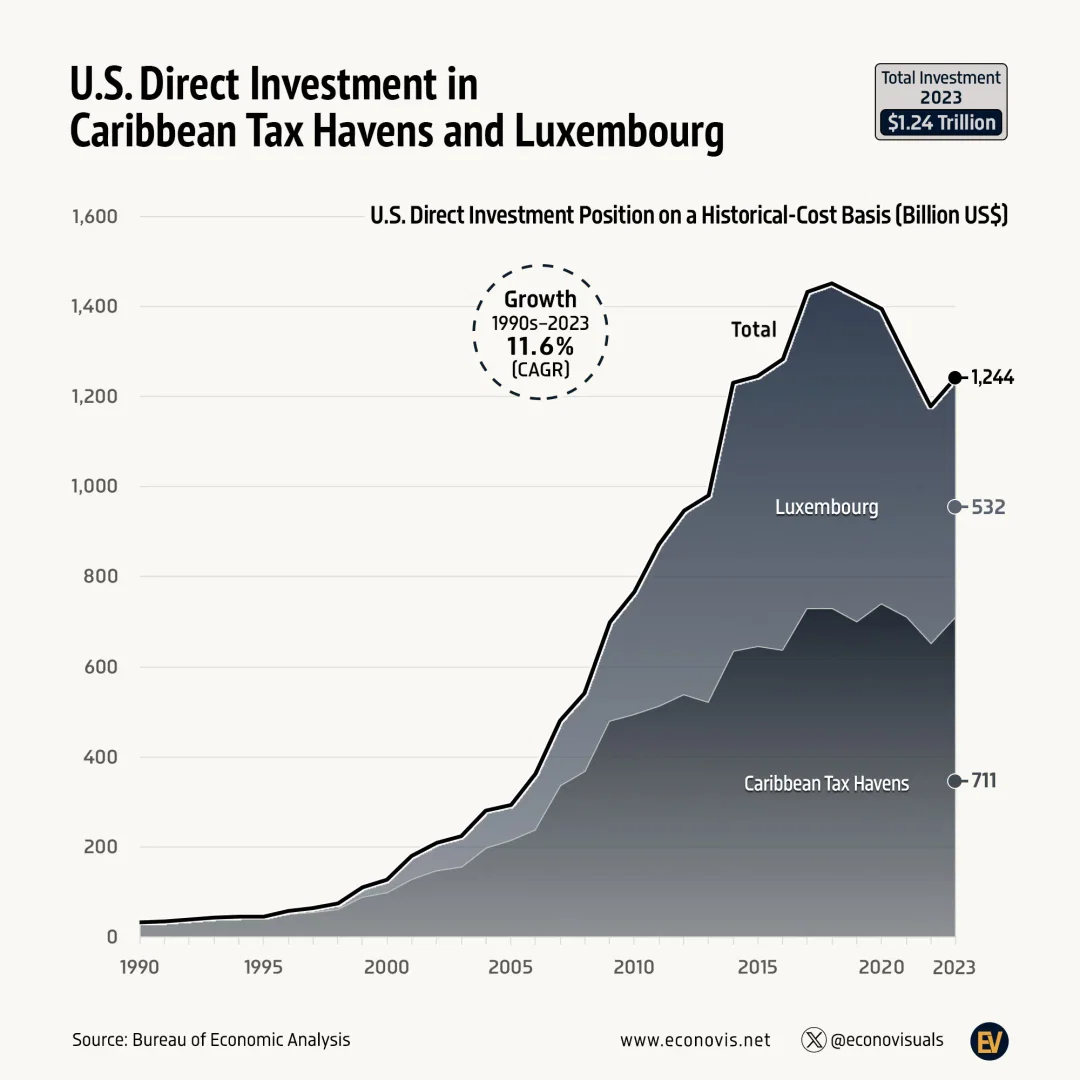

CREDIT—BUREAU OF ECONOMICS ANALYSIS AND WWW.ECONOVIS.NET

The World’s Biggest Tax Haven Under Donald Trump. Donald Trump policies discovered how Trump’s policies are turning America .Now America is becoming a global tax haven, impacting taxes, trade, and the economy. Read more at AMERICA NEWS WORLD.

Donald Trump’s policies are reshaping America’s role in the global economy. According to a recent Stabroek News article by Joseph E. Stiglitz, the United States is becoming the world’s largest tax haven. This shift is raising eyebrows worldwide. It affects everyday people, businesses, and global trade. Let’s break it down in simple terms. We’ll explore what’s happening, why it matters, and how it impacts you. This article, published by AMERICA NEWS WORLD (ANW), dives deep into the issue with clear facts, visuals, and insights for readers across all ages and continents.

America has long been a global economic leader. But now, it’s gaining a new title: the world’s biggest tax haven. Why? Trump’s administration is making bold moves. For example, the Treasury Department is pulling out of transparency rules. These rules once shared the real identities of company owners. Without them, it’s easier for the ultra-rich to hide money. Additionally, the U.S. has stopped negotiating a UN tax cooperation framework. This framework aimed to ensure fair taxes globally. Meanwhile, the government is easing crypto regulations and pausing anti-corruption laws. These changes make it simpler for wealthy individuals and corporations to avoid taxes.

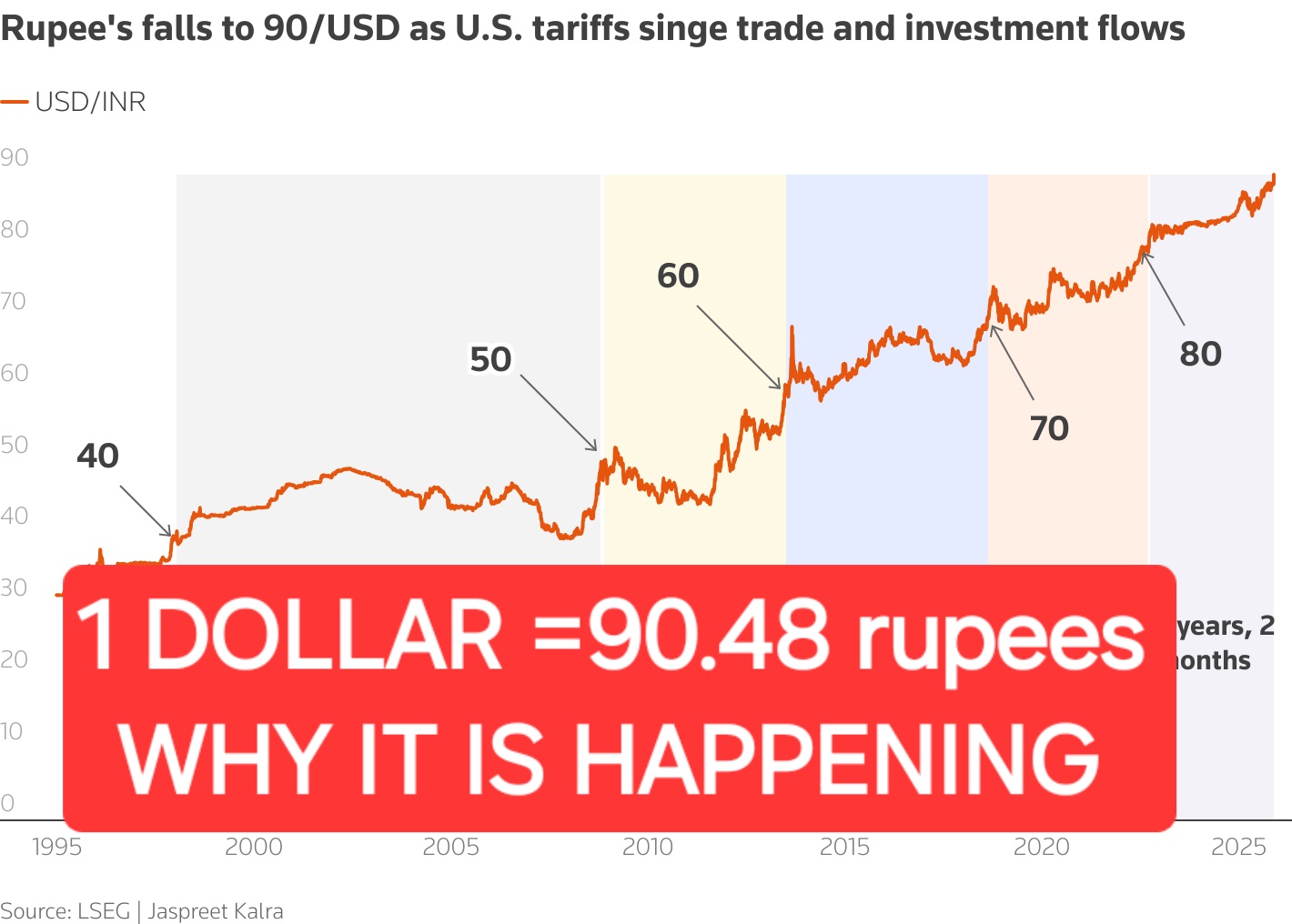

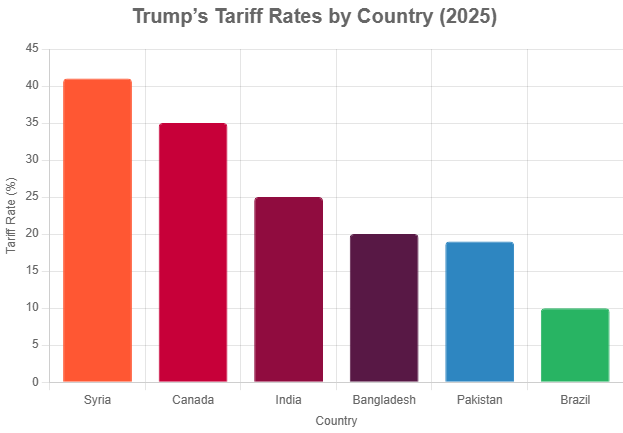

But that’s not all. Trump loves tariffs. He believes import tariffs bring in money to cut taxes for billionaires. However, tariffs raise prices for everyday Americans. For instance, when importers pay tariffs, they pass costs to consumers. This means higher prices for groceries, clothes, and electronics. Moreover, tariffs are hitting at a bad time. The U.S. is recovering from inflation. Higher prices could spark stagflation—a mix of high inflation and slow growth. According to NBC News, markets are already feeling the heat, with fears of economic slowdown growing.

Let’s talk about the trade deficit. Trump thinks tariffs will shrink it. But that’s not how it works. Basic economics shows trade deficits come from a gap between savings and investment. Trump’s tax cuts for the rich widen this gap. Why? Because tax cuts reduce government revenue, which lowers national savings. As a result, the trade deficit grows. This contradicts Trump’s goal of boosting U.S. manufacturing. Instead, his policies could hurt the economy.

Furthermore, tax cuts for the wealthy don’t deliver promised benefits. Since Reagan, conservatives have said tax cuts boost growth. But history disagrees. Reagan’s cuts didn’t pay off. Neither did Trump’s 2017 Tax Cuts and Jobs Act. Studies show these cuts increase inequality without growing the economy. Extending the 2017 cuts could add $37 trillion to the U.S. debt over 30 years. That’s a massive burden for future generations.

America’s economy is shifting to services like tourism, education, and healthcare. These are major exports. But Trump’s policies are hurting them. For example, arbitrary detentions and visa cancellations scare off tourists and students. Defunding science research also weakens universities. Who would study or visit a country with such risks? These moves shrink America’s global appeal.

China, a key trading partner, is retaliating. It raised duties on U.S. goods to 125%. This hurts American exporters and consumers. Markets are volatile. Stocks and bonds are feeling the pressure. If stagflation hits, prices could soar while jobs stagnate. This affects everyone, from young workers to retirees.

Elon Musk’s Department of Government Efficiency adds another layer. It’s slashing IRS staff. Fewer workers mean weaker tax enforcement. This could cut tax revenue by 10% this year. Over a decade, the U.S. might lose $2.4 trillion in revenue. Compare that to the $637 billion boost planned under Biden’s Inflation Reduction Act. Less revenue means bigger deficits and fewer public services.

Crypto is another concern. Cryptocurrencies thrive on secrecy. They’re perfect for hiding money. Trump’s team is loosening crypto rules. He even signed an order for a “strategic cryptocurrency reserve.” A crypto insider now leads the SEC. These moves make it easier for tax evasion and money laundering. The global illicit economy is growing, and America is enabling it.

What does this mean for the world? International cooperation is key to fair taxation. But America is stepping back. It’s halting data collection on company owners and abandoning global tax agreements. This weakens efforts to combat tax avoidance. Other countries are moving forward. Over 50 nations are adopting a 15% minimum tax on multinationals. The G20 is pushing for the ultra-rich to pay their share. Without U.S. support, global tax rules could strengthen. But for now, America’s actions favor the wealthy.

Why It Matters to You

This isn’t just about billionaires. Higher tariffs mean pricier goods. Weaker tax enforcement means less money for schools, roads, and healthcare. A bigger trade deficit could slow job growth. For young readers, this shapes your future job market. For older readers, it affects retirement savings and healthcare costs. Across continents—whether in India, the USA, or elsewhere—these changes ripple. Global trade wars hurt everyone.

Data

Let’s visualize the impact. Below are key stats and graphs, optimized for mobile and desktop viewing.

data 1: U.S. National Debt Projection (2025-2055)

Source: AMERICA NEWS WORLD Analysis

- Current Debt: $33 trillion (2025)

- With 2017 Tax Cuts Extended: $70 trillion by 2055

- Without Extension: $50 trillion by 2055

Highlighter: The red line shows debt soaring if tax cuts continue. The blue line shows a more stable path without them.

data 2: Tariff Impact on Consumer Prices (2024-2025)

Source: AMERICA NEWS WORLD Analysis

- Pre-Tariff Inflation: 3% (2024)

- Post-Tariff Inflation: 5-7% (2025 estimate)

Table: IRS Staffing and Revenue Loss

| Year | IRS Staff | Revenue Loss ($B) |

|---|---|---|

| 2025 | 50,000 cut | 240 |

| 2035 | Sustained | 2,400 |

| Source: AMERICA NEWS WORLD, based on Stiglitz’s estimates |

Highlighter: Cutting 50,000 IRS workers could cost $2.4 trillion over a decade.

Global Perspective

Readers in India, the USA, and beyond should care. India’s economy relies on global trade. U.S. tariffs could raise costs for Indian exporters. In the USA, consumers face higher prices. In Africa, Asia, and Europe, weaker global tax rules let the ultra-rich dodge taxes, starving public services. This is a global issue with local impacts.

Trump’s policies are transforming America into a tax haven. Tariffs, crypto deregulation, and IRS cuts favor the wealthy. But they hurt everyday people. Higher prices, bigger deficits, and weaker services are real risks. This affects readers in India, the USA, and globally. Stay informed with AMERICA NEWS WORLD for clear, honest news. Share this article to spark discussion. Together, we can understand and navigate these changes.

Discover more from AMERICA NEWS WORLD

Subscribe to get the latest posts sent to your email.

![Smoke rises after Israeli strikes in Beirut's southern suburbs, on March 2 [Mohamad Azakir/Reuters]](https://america112.com/wp-content/uploads/2026/03/hgh.webp)